The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) has projected a sustained reduction in the prices of petrol, diesel and Liquefied Petroleum Gas (LPG) across the country, citing improved supply conditions and growing competition within the energy market.

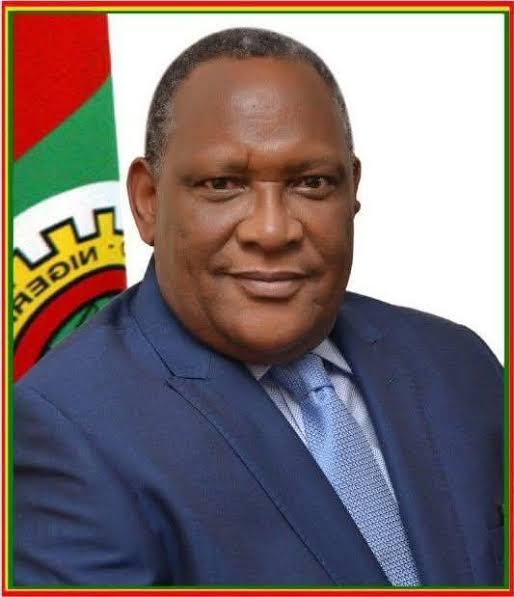

The Authority’s Chief Executive Officer, Saidu Mohammed, disclosed this during a facility inspection visit to Aradel Holdings Plc in Ogbele, Ahoada East Local Government Area of Rivers State. According to him, increased private sector investment and rising product availability are steadily pushing prices downward.

Mohammed explained that as supply improves, market forces naturally drive prices lower, noting that the current competition in the downstream sector has already reduced petrol prices from about ₦1,000 per litre to roughly ₦800 in some areas. He added that Nigerians are gradually transitioning toward more affordable energy as supply stability improves.

He attributed the positive trend to the removal of fuel subsidies, which he said has allowed the market to operate more efficiently. According to him, sustained competition, rather than government subsidies, is the most reliable way to ensure consistent availability of petroleum products at reasonable prices.

The NMDPRA boss emphasized the importance of expanding Nigeria’s refining capacity, particularly refineries equipped with advanced conversion units capable of producing petrol, diesel, LPG, fuel oil and naphtha. He stated that while Nigeria aims to become a major exporter of petroleum products to regions such as Africa, Europe and the Americas, meeting domestic demand must remain the first priority.

Mohammed also reiterated President Bola Tinubu’s commitment to a free-market economic framework, describing subsidy removal as a bold policy decision that unlocked private capital and boosted investor confidence across the oil and gas value chain.

Speaking on the state-owned refineries, he clarified that their operational management largely falls under the Nigerian National Petroleum Company Limited (NNPCL). However, he said NMDPRA is actively engaging with NNPCL to ensure consistent crude oil supply and product evacuation at the Port Harcourt and Warri refineries.

He noted that restoring product loading at these facilities would stimulate economic activities within host communities and revive local distribution networks, even ahead of full-scale refinery operations.

Mohammed further stressed that Nigeria’s long-term economic growth depends heavily on the expansion of indigenous midstream infrastructure. He said the facilities inspected during his three-day tour of Rivers State demonstrated the ability of Nigerian companies to independently develop and manage world-class energy assets.

He highlighted Aradel Holdings as a strong example, stating that the company has shown that local operators can sustainably run a refinery without foreign technical partners. According to him, Aradel’s ongoing expansion project is expected to enable petrol loading from its refinery before the end of 2027.

Mohammed revealed that Aradel has been supplying gas to Nigeria Liquefied Natural Gas (NLNG) for over a decade, operates an 11,000-barrel-per-day refinery, and runs a virtual gas pipeline system that distributes compressed natural gas to various parts of the country.

He called for increased investments in refining capacity, noting that even large facilities such as the Dangote Refinery cannot single-handedly meet Nigeria’s domestic, regional and global fuel demand. He described the midstream sector as a critical engine for economic growth, with the potential to drive industrialization, power generation, transportation and other key sectors.

The NMDPRA chief assured investors that the Authority would continue to provide regulatory incentives aimed at attracting large-scale investments into the midstream segment of the industry.

In his response, Aradel Holdings’ Managing Director, Adegbite Falade, expressed appreciation for the regulator’s support and reaffirmed the company’s commitment to expanding refining capacity, commercialising gas resources and eliminating routine gas flaring.

Falade said Aradel is proactively scaling its operations to meet rising energy demand, adding that the company intends to play a long-term role in addressing Nigeria’s energy supply challenges through local value creation and prioritisation of domestic needs.