The Senate on Tuesday approved President Bola Tinubu’s 2025–2026 External Borrowing (Rolling) Plan, which includes requests to borrow $21.8 billion, €2.1 billion, and ¥15 billion, as well as a €65 million grant, to finance key projects and programmes across various sectors of the economy.

In addition, the Senate approved the issuance of a ₦757.98 billion Federal Government bond in the domestic market to offset outstanding pension liabilities under the Contributory Pension Scheme (CPS).

Also approved was the President’s request to raise to $2 billion in the domestic market through a Foreign Currency-Denominated Instrument Local Issuance Programme—a novel initiative backed by Presidential Executive Order No. 16 of 2023, which empowers the Debt Management Office (DMO) to access dollar liquidity within the country without exerting additional pressure on foreign reserves.

These approvals followed the recommendations of the Senate Committee on Local and Foreign Debts, chaired by Senator Aliyu Wamakko.

Despite the approvals, debate on the floor was tense. Some lawmakers expressed strong reservations about the sustainability of Nigeria’s mounting debt load.

Senator Abdul Ningi was among those who opposed the motion, warning: “Generations after us will continue to pay these loans. I’ve gone through the documents and cannot find a clear repayment plan.”

However, other senators, including Adetokunbo Abiru and Finance Committee Chairman Sani Musa, defended the proposals, describing the loan terms as flexible and growth-oriented.

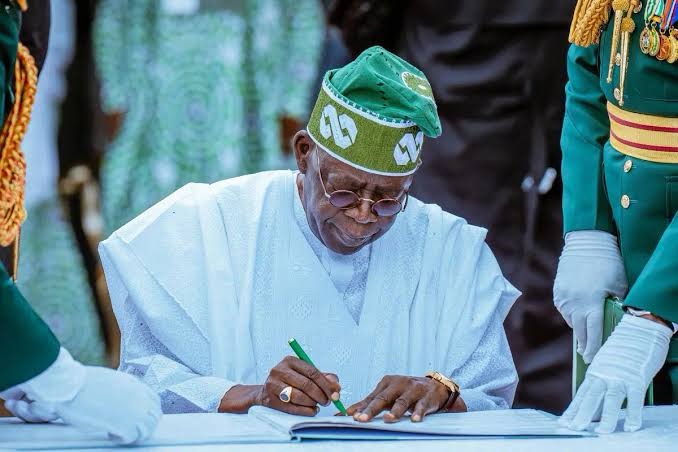

Tinubu submitted the borrowing requests on May 27, emphasising the need to support critical projects in infrastructure, health, education, water supply, and other strategic areas.

The decision comes at a time when Nigeria’s total public debt stock has surpassed ₦121 trillion, with external debts exceeding $43 billion as of mid-2024. Debt servicing now consumes more than 90 per cent of federal revenue, prompting sharp criticism from economists and civil society groups.

“This is a country living on credit,” an opposition lawmaker told journalists. “People are suffering from inflation and joblessness while the government continues to dig deeper into debt.”

Still, supporters argue that the borrowing plan is different from past patterns.

“This isn’t reckless borrowing,” a committee member stated. “It’s a strategic investment to stimulate jobs, growth, and foreign exchange inflows.”

The approved loans and bond issuances are reportedly ring-fenced for high-impact, high-return projects across power, transport, the digital economy, and social sectors, subject to appropriation by the National Assembly.

A significant portion of the domestic bond—₦757.98 billion—is earmarked for the settlement of longstanding pension arrears. The move is expected to bring relief to thousands of retirees still awaiting full payment of their entitlements.

The DMO is expected to float the bond locally, reducing exposure to external risk. However, analysts caution that the government must ensure transparency and fiscal discipline in its execution.

This provides some short-term fiscal space, but if the investments don’t yield quick, measurable returns, we’re simply deepening the debt trap.

Tuesday’s approvals give the Tinubu administration the green light to broaden its fiscal reach. But the pressure is now on for results. For ordinary Nigerians facing inflation, currency instability, and subsidy removals, the biggest question remains: Will this borrowing bring real relief, or more hardship?